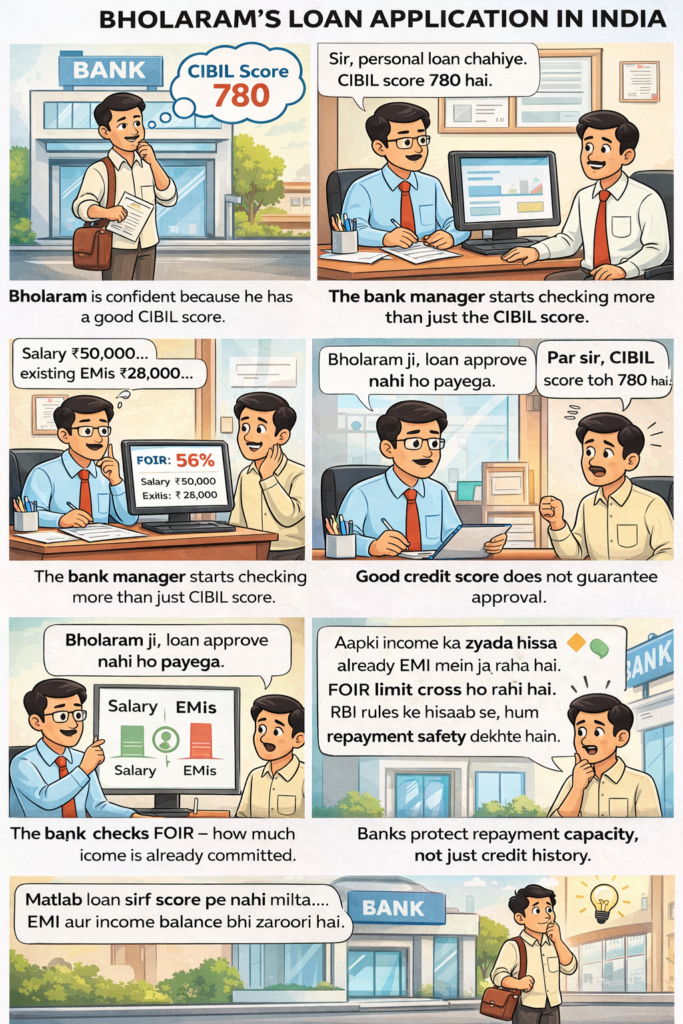

A common misconception among loan applicants in India is that a good CIBIL score guarantees loan approval. In reality, banks frequently reject loan applications despite a healthy credit score. This often surprises borrowers and creates confusion or mistrust in the banking process.

From a banker’s perspective, a credit score is only one input, not the final decision-maker. Indian banks follow a multi-layered credit appraisal system governed by RBI prudential norms, internal risk policies, and portfolio-level considerations. Loan approval ultimately depends on repayment capacity, income stability, and risk alignment, not on a single number.

This article explains why banks reject loan applications even when the CIBIL score is good, using the same logic banks apply internally.

Table of Contents

1. Credit Score Shows Behaviour, Not Capacity

A CIBIL score primarily reflects past repayment behaviour, not present or future repayment capacity.

A borrower may have:

- timely repayments in the past

- no defaults or settlements

Yet still lack:

- sufficient monthly income surplus

- stable long-term cash flow

Banks therefore treat the credit score as a qualifying parameter, not a sanctioning parameter.

👉 To understand how credit scores work, read What Is a CIBIL Score and How It Works in Indian Banks and NBFCs

2. High FOIR (Fixed Obligation to Income Ratio)

One of the most common rejection reasons is a high FOIR.

Even with a good credit score, banks will reject an application if:

- Existing EMIs already consume a large portion of income

- Credit card minimum dues are high

- Fixed obligations leave limited monthly surplus

From a risk standpoint, banks must ensure that borrowers can absorb future income shocks without defaulting.

👉 Read What Is FOIR and How Banks Use It to approve loans in India to understand the science behind this. Let’s take an example of Bholaram.

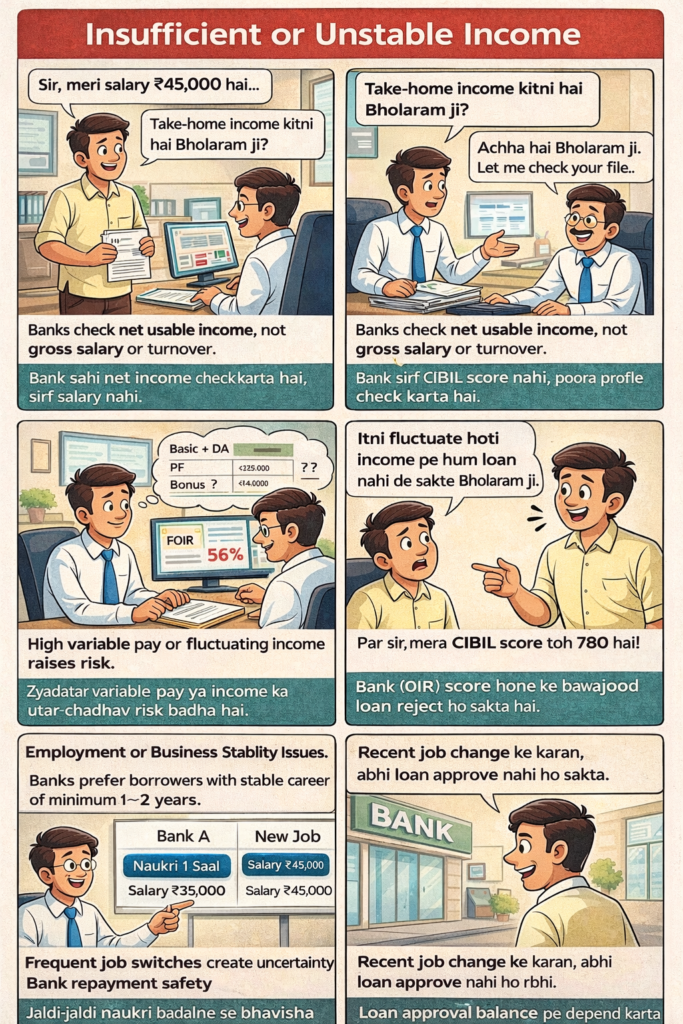

3. Insufficient or Unstable Income

Banks assess net usable income, not gross salary or business turnover.

Rejections occur when:

- Take-home income is overstated

- Variable pay forms a major portion of salary

- Business income fluctuates significantly

- A recent income decline is observed

In credit appraisal, income stability matters more than income size.

4. Employment or Business Stability Issues

Banks closely examine the continuity of income source.

Common red flags include:

- Frequent job changes

- Recent job switch without probation completion

- Business vintage below minimum requirement

- Sharp year-on-year income variation

A good credit score cannot compensate for uncertain future income.

5. Age–Tenure Mismatch

Loan tenure must align with the borrower’s earning life.

Rejections happen when:

- Tenure extends beyond retirement age

- Income continuity post-retirement is unclear

- Business sustainability is uncertain in later years

Banks prefer conservative tenure structures to reduce default probability.

6. Negative Credit Behaviour (Beyond the Score)

Banks look beyond the numeric score and examine the credit report in detail.

Hidden issues include:

- Frequent unsecured loan enquiries

- High credit card utilisation

- Short credit cycles (borrow–repay–borrow pattern)

- Recent loan closures followed by fresh applications

These indicate credit dependency, which increases risk.

👉 Related read: Why Your CIBIL Score Drops Suddenly in India: Real Reasons Banks Check

7. Internal Bank Risk Policies

Each bank has internal sectoral and customer-level risk limits.

Applications may be rejected due to:

- Exposure limits in a specific profession or industry

- Geographic risk concentration

- Portfolio quality concerns

- Falling under caution category or high risk customer

These are portfolio-level decisions, not borrower-specific failures.

8. Documentation Gaps or Mismatches

Loan rejections often occur due to:

- Income mismatch between documents

- Incomplete banking records

- Discrepancies in address or employment proof

- Inconsistent tax filings

Banks are required to maintain documentation integrity under regulatory scrutiny.

9. Nature of Loan Applied For

Sanctioning many a times also depends whether loan is secured or unsecured. Unsecured loans are assessed more strictly than secured loans as it comes without collateral.

Even with a good credit score:

- Personal loans face higher scrutiny

- Higher loan amounts invite deeper checks

- Multipurpose loans are considered riskier

Risk appetite varies by product and types of mortgaged collateral.

10. Conservative Lending Environment

During periods of:

- Economic uncertainty

- Rising interest rates

- Regulatory tightening

Banks become more conservative, raising approval thresholds across the board.This is a systemic decision, not a reflection of individual creditworthiness. You can recall time of COVID when repo rate was drastically decreased and loan became cheaper.

Key Takeaway for Borrowers

A good CIBIL score is necessary but not sufficient.

Banks approve loans based on:

- Repayment capacity

- Income stability

- Risk alignment

- Portfolio considerations

Understanding this helps borrowers:

- Apply realistically

- Reduce rejection chances

- Improve long-term financial discipline

👉 To see how banks combine all these factors, read How Banks Decide Loan Eligibility in India

Conclusion

Loan rejection despite a good credit score is not an anomaly—it is a risk-managed banking outcome. Indian banks are custodians of depositor funds and are required to lend prudently under RBI supervision.

Borrowers who understand how banks think are better positioned to structure their applications correctly, manage expectations, and maintain long-term credit health.

A loan should always be viewed as a long-term financial responsibility, not a short-term entitlement.