In India, the term “minimum CIBIL score” is often misunderstood. Many borrowers believe that banks follow a single fixed score cut-off for loan approval. In reality, minimum CIBIL score requirements vary by loan type, borrower profile, and risk category.

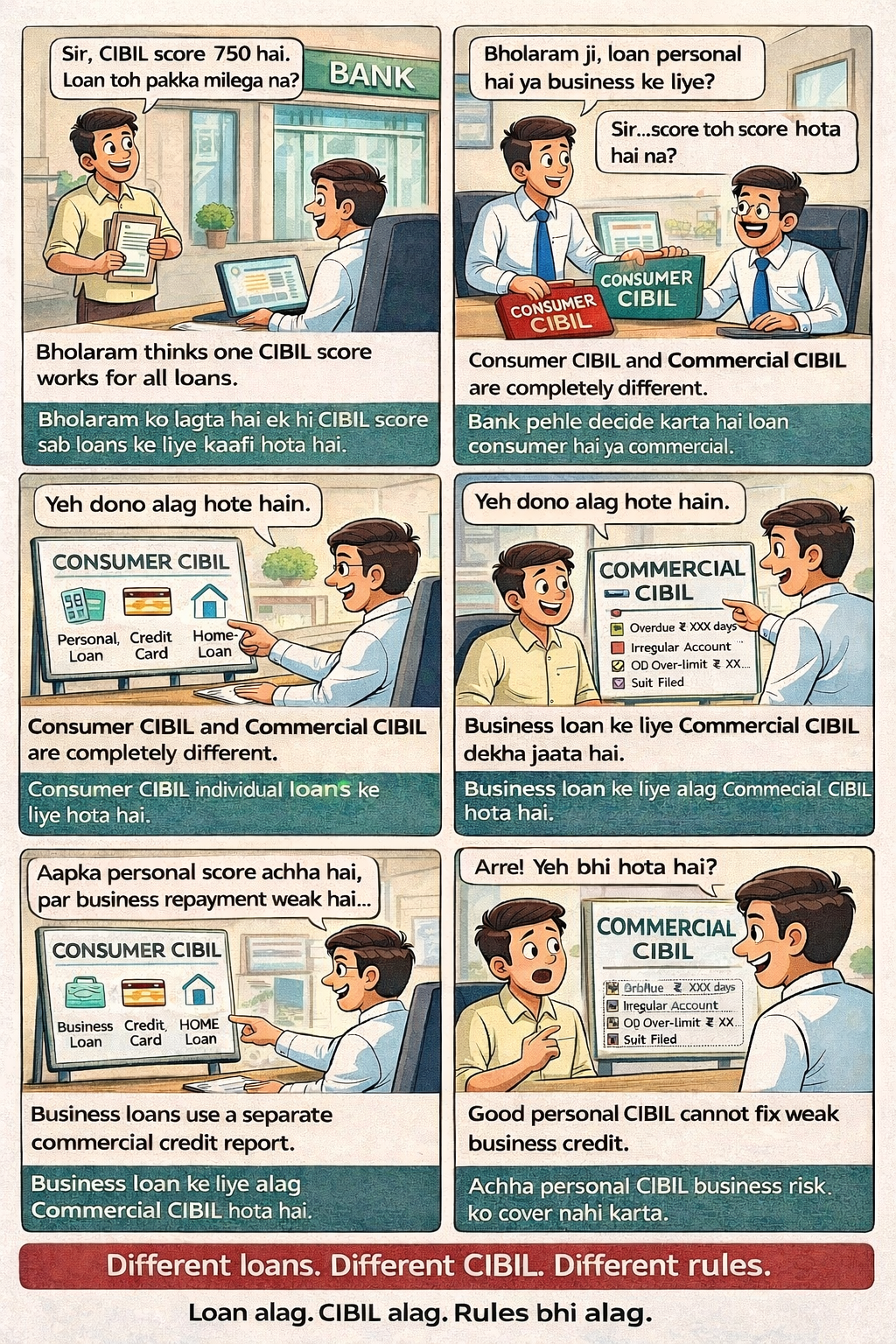

Banks in India assess consumer loans and commercial loans differently, using separate credit reports, scoring logic, and risk benchmarks. Understanding these differences helps borrowers apply realistically and avoid unnecessary rejections.

This article explains:

- Minimum CIBIL score required for different consumer loans

- Minimum CIBIL score expectations for commercial/business loans

- How to read and interpret consumer CIBIL vs commercial CIBIL reports

Table of Contents

What Does “Minimum CIBIL Score” Really Mean?

A CIBIL score is a risk indicator, not a pass–fail certificate.

From a banker’s perspective:

- A higher score improves probability of approval

- A lower score increases scrutiny, but does not always mean rejection

- Final approval depends on income, FOIR, stability, and risk policies

Banks use the score to classify risk, not to automate approvals. How do banks decide loan eligibility in India?

Section A : Minimum CIBIL Score for Consumer Loans (Individual Borrowers)

Consumer CIBIL applies to individuals, salaried or self-employed, borrowing for personal needs.

2. Personal Loan – Minimum CIBIL Score

- Preferred range: 720 and above

- Acceptable range: 680–719 (with strong income)

- Below 680: High rejection probability

Personal loans are unsecured, so banks rely heavily on credit behavior and repayment discipline.

3. Home Loan – Minimum CIBIL Score

- Preferred range: 700 and above

- Acceptable range: 650–699 (case-to-case)

Home loans are secured by property, so banks can be slightly flexible, especially for:

- Stable salaried borrowers

- Lower loan-to-value (LTV) cases

4. Car Loan – Minimum CIBIL Score

- Preferred range: 680 and above

- Below 650: Usually rejected or priced higher

Vehicle loans fall between personal and home loans in risk.

5. Credit Card – Minimum CIBIL Score

- Preferred range: 720 and above

- 650–719: Limited card options

- Below 650: Mostly declined or offered secured cards

Credit cards are revolving credit products generally unsecured, so banks are cautious.

6. Education Loan – Minimum CIBIL Score

- No strict minimum for small loans

- Parental / co-applicant credit profile matters more

- Genrally collateral is not asked for loans up to 4 lakh

Banks focus on:

- Institution quality

- Course employability

- Co-borrower repayment capacity

Click on What is CIBIL Score and How It Works in Indian Bank and NBFCs? to understand the pattern of Cibil Score and its model . Click here to pull cibil report

SECTION B: Minimum CIBIL Score for Commercial/Business Loans

Commercial CIBIL applies to business entities, not individuals.

Banks use CIBIL Commercial Reports, not consumer reports, for:

- Proprietorships

- Partnerships

- Companies

- MSMEs

7. Business Loan – Minimum CIBIL Score (Commercial CIBIL)

Commercial CIBIL does not have a score; banks assess business credit behavior and repayment conduct.

Banks evaluate:

- Repayment track record

- Loan utilization behaviour

- Cash flow consistency

8. Working Capital / OD / CC Facilities

- Commercial score + banking conduct matter more than score alone

- Irregular account operations reduce approval chances

For business lending, account behaviour often outweighs the score.

9. Key Difference in Commercial Lending

In commercial loans:

- Business performance > credit score

- Cash flows > past borrowing history

- Banking discipline > numeric score

This is fundamentally different from consumer lending.

SECTION C: How to Read Consumer CIBIL vs Commercial CIBIL

10. How to Read a Consumer CIBIL Report

Consumer CIBIL focuses on:

- Credit score (300–900)

- Payment history

- Credit utilisation

- Loan enquiries

- Defaults or settlements

It answers one question:

Is this individual disciplined in repaying personal credit?

11. How to Read a Commercial CIBIL Report

Commercial CIBIL focuses on:

- Business borrowing history

- Overdues and restructuring

- Multiple lender exposure

- Suit-filed or legal flags

- Company / firm identifiers

It answers a different question:

Is this business financially reliable and bank-worthy?

12. Why Many Business Owners Get Confused

Common mistake:

- Good personal CIBIL, weak commercial CIBIL

Banks may reject business loans even when:

- Personal score is high

- Individual repayment is good

Because business credit risk is assessed independently.why banks reject loan applications even with good CIBIL score?

Key Takeaways for Borrowers

✔ Consumer Loans

- Aim for 700+ CIBIL score

- Maintain low credit utilisation

- Avoid frequent enquiries

✔ Commercial Loans

- Maintain clean business banking

- Avoid cheque returns and over-leveraging

- File returns and repayments on time

Conclusion

There is no single minimum CIBIL score applicable to all loans in India. Banks apply different score expectations for consumer and commercial lending, based on risk, security, and repayment predictability.

Borrowers who understand which CIBIL report applies to them and how banks interpret it are better positioned to plan credit responsibly and avoid rejections.

A good credit score opens doors—but financial discipline keeps them open.