The debate around public sector banks vs private sector banks in India is not new. Questions such as “Which bank is safer?”, “Which bank earns more profit?”, “Where do more people work?” and “Which banks will dominate the future?” are frequently discussed—but rarely explained with data and internal banking logic.

To understand this topic properly, one must move beyond surface-level comparisons and understand:

- How banks actually make money

- What asset quality, CASA, NPA, NIM really mean

- How RBI laws classify banks

- Why private banks have surged ahead in recent decades

This article explains the difference between public and private sector banks in India using RBI structure, banking laws, real numbers, internal metrics, and future outlook.

1. What Is a Bank and a Commercial Bank

Under the Banking Regulation Act, 1949, banking means:

Accepting deposits from the public for lending or investment.

A commercial bank therefore:

- Accepts public deposits (Savings, Current, FD)

- Lends money (Loans, Advances)

- Earns income through interest spread and fees

👉 Both public and private sector banks are commercial banks.

This distinction is important when understanding how banks assess credit risk internally.

2. What Is a Scheduled Bank? (RBI Act, 1934)

A scheduled bank is one listed in the Second Schedule of the RBI Act, 1934.

Why Scheduled Status Matters

Only scheduled banks can:

- Borrow from RBI (repo, MSF, LAF)

- Participate in clearing & settlement

- Act as monetary policy transmission channels

👉 All public and private sector banks are scheduled commercial banks.

3. Classification of Commercial Banks in India (Current Structure)

A. Public Sector Banks (PSBs)

- Government ownership > 50%

- Current number: 12 PSBs

- Examples: SBI, PNB, Bank of Baroda, Canara Bank

Why they exist:

Nationalisation (1969, 1980) aimed at:

- Financial inclusion

- Agricultural & MSME lending

- Economic development

B. Private Sector Banks

- Majority private ownership

- Current number: 21 private banks

- Examples: HDFC Bank, ICICI Bank, Axis Bank, Kotak Mahindra

Private banks expanded rapidly after 1991 liberalisation, focusing on:

- Technology

- Risk-based lending

- Profitability

4. Employment: Who Employs More People?

Historical Reality

For decades, PSBs dominated employment due to:

- Larger branch networks

- Manual operations

- Job security

Current Reality (Turning Point)

- PSBs: ~7.7 lakh employees

- Private banks: ~7.9 lakh employees

👉 For the first time in 50+ years, private banks employ more people than PSBs.

Between 2013–2022:

- PSB staff ↓ ~13%

- Private bank staff ↑ ~240%

This shift reflects technology-driven banking.

5. How Banks Actually Make Money

At its core, banking is a money-rotation business.

A bank does not create wealth magically — it moves money from savers to borrowers and earns in between.

The banking model has only three fundamental steps:

- Borrow money from the public (deposits)

- Lend money to borrowers (loans)

- Earn the interest spread (difference between lending and borrowing cost)

Step 1: Banks Borrow Money (Deposits)

When you keep money in:-

- Savings account

- Current account

- Fixed deposit (FD)

👉 You are lending money to the bank

👉 The bank is the borrower

The bank must pay you interest for using your money.

Step 2: Banks Lend Money (Loans)

Banks lend this deposited money as:

- Home loans

- Personal loans

- Business loans

- Credit cards

Borrowers pay much higher interest than what depositors receive.

Step 3: Interest Spread (Bank’s Core Earnings)

Simple example:

- Bank pays 3% interest on savings account

- Bank lends that money at 10% interest

👉 Interest Spread = 10% − 3% = 7%

This 7% is used to cover:

- Salaries

- Branch & technology costs

- Loan losses (NPAs)

Whatever remains becomes bank profit.

Technical Terms Explained Simply

1️⃣ CASA – Current Account Savings Account

CASA tells us how much “cheap money” a bank has.

Why CASA is the Cheapest Source of Funds

| Account Type | Interest Paid by Bank | Cost to Bank |

|---|---|---|

| Current Account | 0% | Cheapest |

| Savings Account | ~3–4% | Cheap |

| Fixed Deposit | ~6–7% | Expensive |

Explanation in simple words:

- Current Account (CA):

Businesses keep money → bank pays zero interest - Savings Account (SA):

Bank pays only 3–4% interest - FD:

Bank must pay high interest, so it’s costly

👉 Therefore, CASA = low-cost fuel for the bank

Why Higher CASA = Higher Profitability

Comparison Example (Very Important)

Bank A (High CASA – Typical Private Bank)

- CASA ratio: 50%

- Average cost of funds: ~3.5%

- Loan interest earned: 10%

👉 Interest spread ≈ 6.5%

Bank B (Low CASA – Typical PSU Bank)

- CASA ratio: 35%

- Heavy FD dependence

- Average cost of funds: ~5.5%

- Loan interest earned: 10%

👉 Interest spread ≈ 4.5%

Final Result:

On every ₹100 lent:

- Bank A earns ₹6.5

- Bank B earns ₹4.5

👉 Over thousands of crores, this difference becomes massive profit gap

📌 This is the single biggest reason why private banks outperform PSBs financially.

2️⃣ NIM – Net Interest Margin

NIM measures how efficiently a bank earns from its deposits.

Formula

NIM = (Interest Earned − Interest Paid) ÷ Total Assets

Interpretation:

- Higher NIM = better profitability

- Lower NIM = pressure on profits

Key link:

- Higher CASA → lower interest paid

- Lower interest paid → higher NIM

👉 Private banks usually have higher NIM because they protect CASA aggressively.

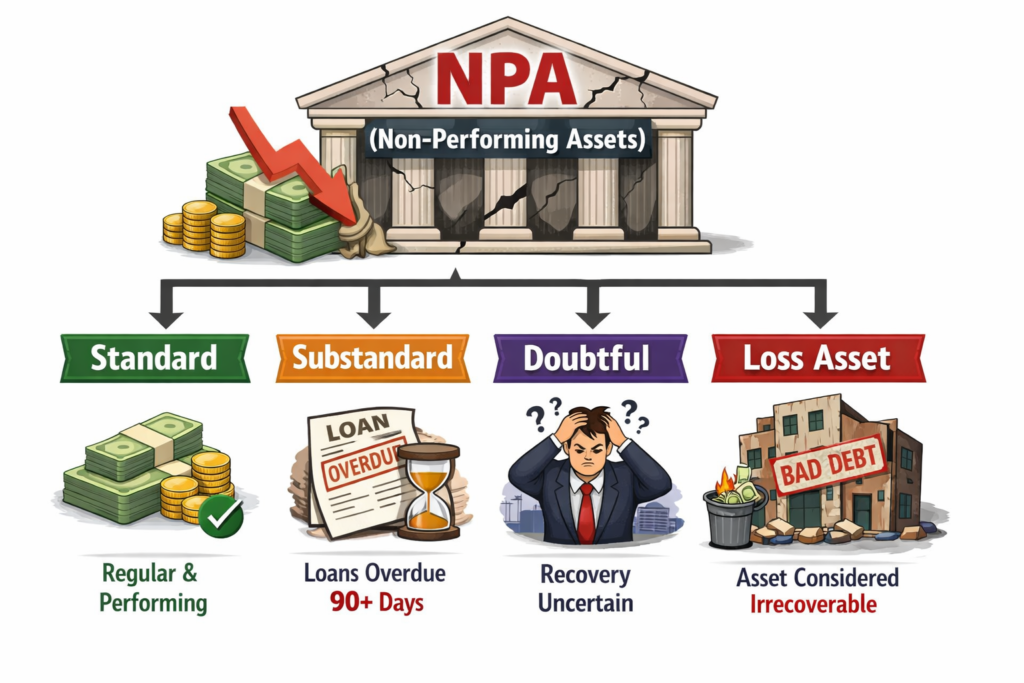

3️⃣ Asset Quality & NPA (Non-Performing Assets)

Banker’s Reality:

For a bank, loans are assets.

- If borrower repays → asset performs

- If borrower stops paying → asset becomes NPA

What is NPA?

A loan becomes NPA when:

- EMI or interest is overdue for 90 days or more

Poor asset quality means:

- Interest income stops

- Bank must set aside capital (provisions)

- Profits fall sharply

Why PSU Banks Historically Had Higher NPAs

- Policy-driven lending

- Loan waivers impacting repayment culture

- Large corporate defaults

- Slower recovery mechanisms

Private banks:

- Stricter borrower selection

- Aggressive recovery

- Faster write-offs

👉 This is why credit discipline and borrower selection matter so much in banking.

CASA decides how cheaply a bank gets money.

NIM decides how efficiently it earns.

Asset quality decides how much it finally keeps.

6. Asset Quality: The Biggest Divider

NPA Comparison (Indicative)

- PSBs historically had double-digit NPAs

- Private banks typically maintain NPAs around 4–5%

Why PSBs Suffer More NPAs

- Political loan waivers

- Large corporate defaults

- Slower recovery mechanisms

Private banks:

- Aggressive recovery

- Faster write-offs

- Strict risk controls

This explains why banks reject loan applications even with good CIBIL score—they prefer prevention over recovery.

7. Deposits, Loans & Market Share Shift

Deposits (CASA + FD)

- PSBs once held ~85% of deposits

- Private banks have steadily gained share

Loans

- PSBs dominated earlier

- Incremental loans today are led by private banks

Public trust has shifted gradually, not suddenly.

8. Profitability & Market Capitalisation (Reality Check)

Profit Comparison (Indicative)

- Top private banks generate more profit than multiple PSBs combined

- SBI is the only PSB competing at scale

Market Capitalisation

- HDFC Bank, ICICI Bank, Kotak alone > most PSBs combined

- Market values efficiency and asset quality, not size

9. Public vs Private Banks – Banker View

| Area | Public Sector Banks | Private Sector Banks |

|---|---|---|

| Objective | Stability & inclusion | Profit & efficiency |

| Risk appetite | Policy-driven | Data-driven |

| Recovery | Slow, regulated | Aggressive |

| Technology | Improving | Advanced |

| Crisis role | Counter-cyclical | Capital-protective |

10. Future Outlook: Who Will Lead?

Public Sector Banks

- Will remain system stabilisers

- Needed for:

- Rural India

- Government schemes

- Crisis lending

Private Sector Banks

- Will dominate:

- Retail lending

- Credit cards

- Digital finance

Borrowers often begin credit journeys with structured products like

👉 secured credit cards explained and gradually migrate to private banks as profiles improve.

11. So Which Is Better?

There is no absolute winner.

- Use PSBs for:

- Stability

- Long-term loans

- Government-linked needs

- Use private banks for:

- Speed

- Digital services

- Credit products

A financially disciplined individual often uses both, supported by buffers like

👉 emergency fund planning for Indian families

Frequently Asked Questions (FAQs): Public vs Private Sector Banks in India

1. Are all public sector banks (PSBs) and private banks scheduled banks?

Yes. All public sector banks and private sector banks in India are scheduled commercial banks under the RBI Act, 1934.

Explanation:

A scheduled bank is one that is included in the Second Schedule of the RBI Act, 1934. Scheduled banks meet RBI’s criteria regarding capital adequacy, governance, and depositor safety.

Being a scheduled bank allows access to RBI liquidity facilities such as repo, MSF, and clearing systems. Since both PSBs and private banks perform core banking functions and meet RBI standards, they are included as scheduled commercial banks.

2. What is the difference between a commercial bank and a scheduled bank?

A commercial bank refers to the nature of business, while a scheduled bank refers to RBI classification.

Explanation:

- A commercial bank accepts deposits and lends money.

- A scheduled bank is one recognised by RBI and included in the Second Schedule of the RBI Act.

All PSBs and private banks are both commercial and scheduled, but a bank must first be a commercial bank to become scheduled.

3. Why do private banks earn more profit than public sector banks?

Private banks earn more profit mainly due to higher CASA, better NIM, lower NPAs, and technology-led efficiency.

Explanation:

- Higher CASA reduces cost of funds

- Better NIM means more income per rupee lent

- Lower NPAs protect profits

- Technology reduces operational costs

PSBs, despite scale, often face higher costs and policy-related constraints, which limit profitability.

4. Are public sector banks unsafe compared to private banks?

No. Public sector banks are not unsafe.

Explanation:

PSBs carry implicit sovereign (government) backing and are regulated by RBI. This backing provides stability and depositor confidence.

While PSBs may have lower profitability, they are generally considered systemically important and stable, especially during economic stress.

5. Why does RBI allow private banks to grow faster than public banks?

RBI allows private banks to grow faster to improve efficiency, competition, and innovation in the banking system.

Explanation:

A banking system dominated by only government banks can become inefficient. Private banks introduce:

- Better technology

- Customer service

- Risk-based lending

This competition forces overall system improvement while RBI ensures safety through regulation.

6. Why do PSBs have higher NPAs compared to private banks?

PSBs historically had higher NPAs due to policy-driven lending and slower recovery mechanisms.

Explanation:

Public sector banks often lend to priority sectors, large infrastructure projects, and stressed industries as part of national policy.

Private banks, on the other hand, follow stricter credit filters and faster recovery, leading to better asset quality.

7. If private banks are more profitable, why does India still need PSBs?

India needs PSBs for financial inclusion, economic stability, and counter-cyclical lending.

Explanation:

During crises, private banks often reduce lending to protect capital. PSBs continue lending, supporting:

- Agriculture

- MSMEs

- Government welfare schemes

This stabilising role cannot be replaced by private banks alone.

8. Do both PSBs and private banks follow the same RBI rules?

Yes. Both are governed by the RBI Act, 1934 and Banking Regulation Act, 1949.

Explanation:

While ownership differs, regulatory requirements such as capital adequacy, provisioning, reporting, and inspections are largely the same.

However, PSBs also follow additional government oversight norms.

9. Why are private banks faster in loan approvals?

Private banks use technology-driven credit assessment and automated decision systems.

Explanation:

Private banks rely heavily on:

- Credit scores

- FOIR

- Data analytics

This reduces manual intervention and speeds up approvals. PSBs still involve more human processes, which slows turnaround time.

10. Which is better for customers: public or private sector banks?

Neither is universally better; it depends on the customer’s need.

Explanation:

Private banks are better for speed, digital services, and premium products

PSBs are better for stability, long-term loans, and government schemes

Conclusion

Public and private sector banks are not enemies. They are two arms of the Indian banking system—one providing stability and inclusion, the other efficiency and growth.

Understanding their internal working, asset quality, profitability, and RBI framework transforms this topic from opinion-based debate into informed financial knowledge.

This is how Indian banking should be understood